Do small companies need to worry about balance sheet reconciliations? Many small businesses overlook them, often because they don’t have many items to reconcile. However, once a business has more than just cash—such as prepaid expenses or fixed assets—implementing a reconciliation process becomes a best practice.

During my 20-year tenure at a mid-sized company, we followed a structured approach to balance sheet reconciliations. The key principle was completing reconciliations before the month-end close, not after. This proactive approach ensured that discrepancies were identified and addressed promptly, keeping financial statements accurate and reliable.

Here’s how the process was managed:

1. Monthly Reconciliations

Each team member was responsible for completing assigned reconciliations before month-end. Below are three balance sheet accounts I managed and how reconciliations were handled:

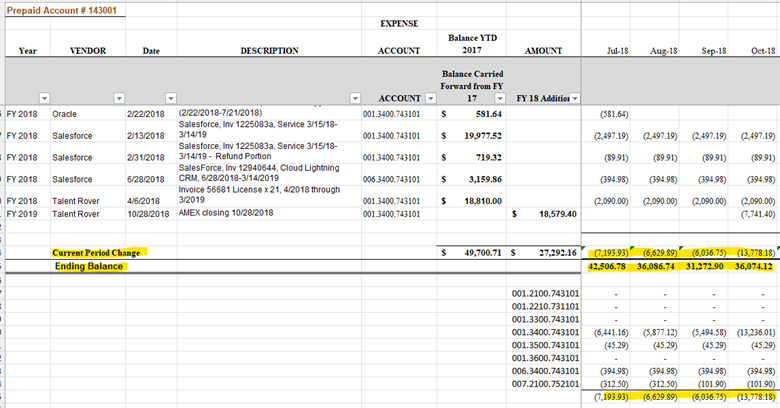

Example 1: Prepaid Expenses

Most companies have prepaid expenses, such as general liability insurance or annual software subscriptions. In our company, any immaterial amount below $1,000 was expensed immediately, a policy designed to simplify accounting. Businesses should determine a threshold that makes sense for them.

A well-structured prepaid schedule provides transparency. The schedule below shows the current month’s entry and the ending balance of the prepaid account, ensuring it matches the balance sheet. This serves as strong support for reconciliation.

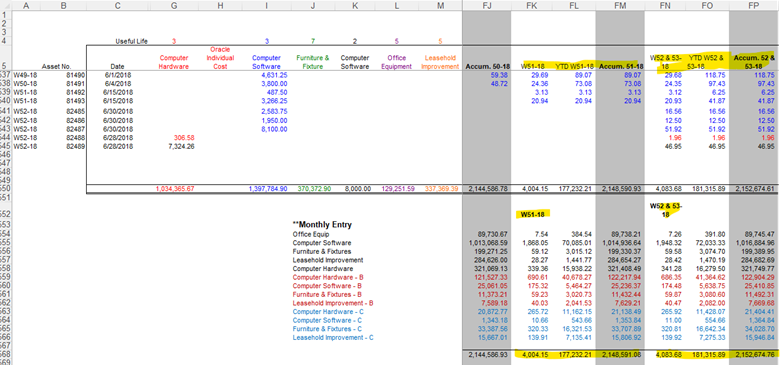

Example 2: Fixed Assets

Tracking fixed assets requires maintaining a schedule that outlines weekly or monthly depreciation per company’s policy, year-to-date depreciation, and total accumulated depreciation. While the format may vary, the key is to align the schedule with your business needs. A proper fixed assets schedule ensures that depreciation expenses tie directly to the balance sheet, preventing discrepancies.

Below is the schedule I created. Since the system processed depreciation weekly, the supporting schedule was also prepared on a weekly basis.

Example 3: Accounts Payable

Most accounting software generates an accounts payable aging report, which can lead some to believe that reconciliation is unnecessary. However, discrepancies between the balance sheet and the aging report are common, often caused by clerical errors. This underscores the importance of maintaining supporting documentation to ensure accuracy.

2. Sign-Off Process

Once reconciliations were completed, they underwent a dual sign-off process. The responsible team member first reviewed and signed off on their work before it was reviewed and approved by the manager. A crucial part of this process was ensuring that managers took the time to conduct a thorough review. Many errors—both mine and my colleagues’—were caught at this stage, reinforcing accountability and internal controls.

3. Month-End Close Meetings

Any issues or questions arising during reconciliations were discussed in month-end close meetings. This collaborative approach helped resolve problems before finalizing financial statements. We encouraged participation from multiple team members, even those not directly responsible for the tasks, to enhance overall financial awareness and understanding.

Conclusion

Balance sheet reconciliations are a crucial part of maintaining accurate financial statements, regardless of company size. By implementing a structured reconciliation process, businesses can identify and correct discrepancies before they impact financial reporting. Whether it’s tracking prepaids, fixed assets, or liabilities, maintaining well-documented reconciliations strengthens financial integrity and internal controls.

For small businesses looking to improve their financial accuracy, starting with regular reconciliations is a smart move. Not only does it help maintain a clear financial picture, but it also builds the foundation for scalable, sound accounting practices.