Employer 401K match contributions can vary significantly based on a company’s policies and management decisions. While some employers match contributions annually, others do so on a more frequent basis, such as weekly. Regardless of the structure, one thing remains constant: accuracy is essential. Ensuring that the correct employer match is funded is not just a compliance matter—it directly impacts employees’ retirement savings and can create additional work if errors go unnoticed.

During my tenure at my previous job, I worked with two distinct 401K matching plans. To maintain accuracy, I created audit worksheets to compare the employer’s match against payroll system reports and verify total contributions. Occasionally, errors surfaced—sometimes due to my own miscalculations and other times due to payroll system data entry mistakes. Regardless of the source, I was ultimately responsible for funding accuracy. Having an audit worksheet proved invaluable, not only in catching discrepancies early but also in providing support during annual audits.

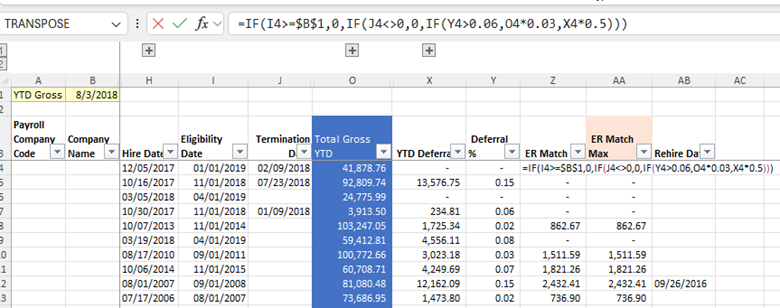

Plan 1: Employer’s Annual 401K Match Contribution

In the earlier years of my role, the company used an annual matching system. The employer made the match contribution once per year in the following year. For example, the match for 2017 was deposited in March 2018, transferring funds directly from the company’s checking account to employees’ 401K accounts.

Eligibility Criteria:

- Employment Duration: Employees had to be employed for at least one year to qualify. Those hired mid-year were not eligible.

- Employment Status: Employees had to be actively employed at the time of the employer’s contribution. If an employee left the company before the match was made, they forfeited their eligibility.

Contribution Matching Details:

- Contributions Over 6%: Employees contributing more than 6% of their annual gross salary received a 3% employer match on their base salary.

- Contributions Under 6%: Employees contributing less than 6% received a 50% match of their total contribution.

- No Match: Employees who made no contributions received no match.

- Maximum Employer Match: The total employer match could not exceed $7,950 per plan year.

- To ensure the accuracy of these contributions, I developed an audit worksheet to track calculations and compare them against payroll records. This step helped flag potential errors before the funds were allocated.

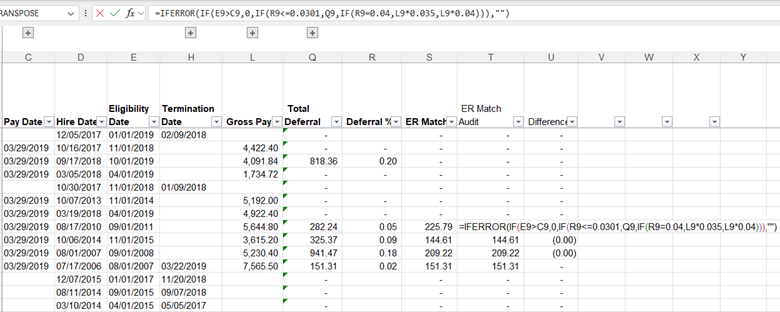

Plan 2: Employer’s Weekly 401K Match Contribution

After the company was acquired by a larger corporation, a new 401K matching policy was introduced. Unlike the previous system, which deposited employer matches once a year, this plan matched employee contributions on a weekly basis through payroll processing. Personally, I found this system more beneficial as it resulted in higher contributions over time and eliminated the issue of forfeited matches due to employment status changes.

Eligibility Criteria:

- Employment Duration: Employees had to be employed for at least one year to qualify.

Contribution Matching Details:

- 100% match on the first 3% of contributions

- 50% match on the next 2% contributions

- No contribution, No match

For this plan, I created a separate audit worksheet to compare payroll reports against expected employer matches. While this verification step wasn’t mandatory, I highly recommend it—especially for companies that have recently changed payroll systems or introduced a new matching structure.

Why Audit Worksheets Matter

Over the years, using audit worksheets significantly improved the accuracy of employer match funding and gave me confidence in my work. While reviewing these calculations may seem like a tedious extra step, it is far better than funding incorrect amounts, which can create even more work to fix later. Ensuring that employees receive the correct employer match not only prevents compliance issues but also builds trust in the payroll and benefits process.

For anyone managing 401K contributions—especially in small businesses—having a verification method in place can be an invaluable tool. Whether your employer match is annual or weekly, taking the time to validate the numbers ensures that both employees and the company benefit from an accurate and reliable retirement plan.