When it comes to managing your books, completeness is crucial. Having a month-end close checklist can make a world of difference. I’ve noticed that some small companies often don’t close their books and make adjustments to past periods whenever they feel like it. This practice can lead to a lot of confusion and errors. If you’re one of those companies, it’s never too late to start a good practice.

I’ve been there myself. When I worked for small companies, I made the same mistake and carried that habit to my last job. As usual, I booked the additional AP invoices to the previous period, and it was a big mistake. The books were already closed, and the financials were sent to the top management. Because of my entry, the financials were altered, and my boss was really upset. Many companies now use sophisticated accounting systems that lock the period, preventing adjustments after the close.

Here are the key takeaways from my experience:

- Don’t make changes after the books are closed. If you need to, always run it by your boss to see if there’s still time to make any adjustments.

- 2. If you don’t have a checklist, create one. It will help you identify errors or missing items before closing the period.

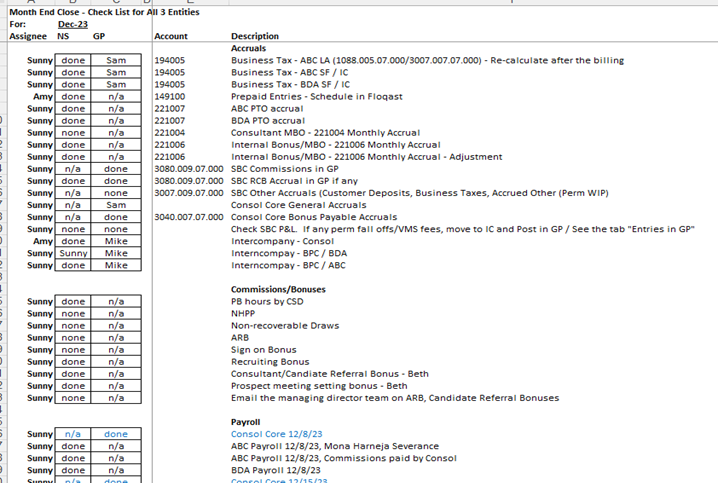

Below is the screen-shot of the part of the month-end checklist I used.

The company I worked for used software for the month-end checklist, so having my own checklist was personal preference which helped me. If you use software such as Floqast, it is easier to see who owns what tasks. If not, you can simply create a list in excel by assignee, tasks, status. While my example might not be the most refined, it should give you a clear idea of what to include.

Month-End Checklist:

*Balance Sheet Items:

1. Accounts Receivable (AR): Reconcile the trial balance to the subledger to catch discrepancies early. Also, examine your aging report by aging bucket. I used to do the AR reconciliation before the bank reconciliation to make sure all receipts were recorded. I will share how I reconciled AR and Allowance for Bad Debt Analysis in a different post.

2. Bank Reconciliation: Ensure all transactions are accounted for to avoid missing items that could impact your income statement. There were times I did this weekly because there were too many transactions. And it was not a bad idea.

3. Prepaid Expenses: Accounting software runs monthly prepaid amortization automatically, which is good. However, I recommend maintaining a support schedule to ensure correct amortization.

4. Inventory: If applicable, obtain the ending balance from the relevant department or individual and verify it against the trial balance. Holding regular meetings to review and approve write-offs for expired goods is also a best practice.

5. Fixed Assets: Review any fixed asset purchases and run depreciation in your accounting software or Excel. I highly recommend maintaining a schedule to track depreciation. Additionally, it’s a good idea to maintain a rollforward schedule to keep a comprehensive record of all changes to your fixed assets.

6. Accounts Payable (AP): Ensure all invoices are received and recorded. Reconcile the trial balance and aging report. It is good practice to keep a list of the AP invoices in big amounts and check with your AP specialist, so nothing big is slipped.

8. Accrued Expenses: Maintain a schedule, review past accruals for reversals, and ensure vendor expenses/invoices are correctly booked against prior accruals. Sometimes, the AP specialist may not be aware of the accruals, so it’s crucial to manage and oversee this process carefully. For instance, if you’ve accrued $10K for client gifts and received a $5K invoice, ensure that the invoice is booked against the accrual account and update the balance on the accrual schedule.

9. Unearned Revenue: If applicable to your business, maintain a schedule to track unearned revenue.

10. Long Term Debt: If applicable to your business, keep a loan schedule and reconcile it to the lender’s statement.

*Income Statement Items:

1. Revenue Accrual: Recognize revenue when earned, not when invoiced. To illustrate, let’s delve into an example from my experience. The company operates on a semi-monthly billing schedule, while timecards are approved on a weekly basis. Consequently, billing doesn’t occur until all timecards have been approved. If the last day of the billing cycle falls on Tuesday, you need to accrue revenue for both Monday and Tuesday to ensure it is posted to the correct period. This also necessitates reversing the revenue accrual in the subsequent period when the billing is completed, to prevent overstating revenue for those two days.

2. Expense Accrual: Review General Ledger (GL) accounts to identify where expenses need to be accrued, including payroll expenses for days not covered by the billing cycle. For instance, if revenue is accrued for Monday and Tuesday, corresponding payroll expenses for those days must also be accrued. This process ensures that both revenue and expenses are accurately recorded in the correct period, maintaining the integrity of the financial statements.

3. Open Purchase Orders & Monthly Invoices: If applicable to your business, ensure that any open purchase orders or regular monthly invoices not yet received are accrued. This process helps you maintain accurate expense tracking and ensures that your financial statements reflect all outstanding liabilities, contributing to better expense control and financial management.

4. Actual to Budget Analysis: Compare actual figures to the budget to identify variances. This process helps to pinpoint areas where your spending or revenue is deviation from the plan, enabling you to take corrective actions and make informed decisions to stay on track.

5. Month-over-Month Analysis: Conduce a thorough review of significant variances to ensure you can substantiate them with appropriate documentation and explanations. This practice not only helps in maintaining accurate financial records but also aids in identifying trends and potential areas of concern, enabling proactive financial management and informed decision making.

By following this checklist, you’ll ensure your financial statements are complete and accurate, setting your business up for success. If you have any questions or need further guidance, feel free to reach out. Happy closing!