When I was a staff accountant, the task of bank reconciliation (bank rec) wasn’t my responsibility. Back then, our company used QuickBooks, and my boss, the controller at the time, didn’t want to assign me that task. Who cared, right?

Then came the implementation of Oracle E-Business Suite, and the bank rec turned into a nightmare for my boss. This was about 20 years ago, and Oracle E-Business wasn’t exactly user-friendly. It was a modular system, and the cash management module required real-time interfacing with the bank — a feature we couldn’t accomplish at that time.

Long story short, the bank rec eventually landed on my desk. That’s when I realized that not every accountant could perform or create a bank rec off the accounting system. It wasn’t just my boss who struggled; even the three college graduates with accounting degrees we later hired couldn’t manage it. The only person who could handle it was a Psychology major we hired. How funny is that?

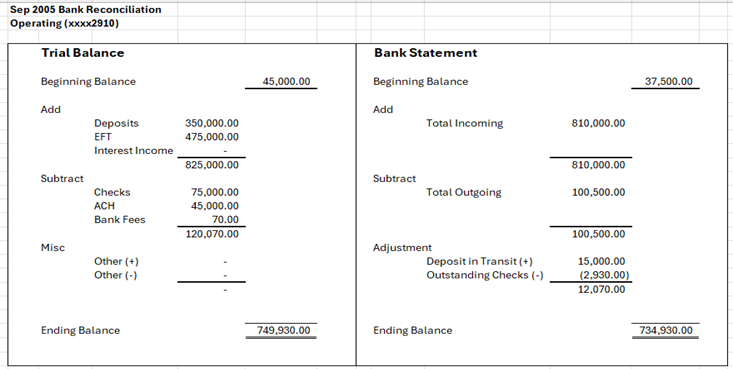

I took matters into my own hands and created a form in Excel. This form allowed me to check and balance the cash in the trial balance against the bank statement. It was a very simple form, based on basic logic from Accounting 101—nothing fancy. This form remained in use for 19 years, surviving the annual audits with a well-known audit firm, one system upgrade, and another system implementation until the company was finally sold.

Here’s the form I want to share. It’s a testament to how sometimes the simplest solutions are the most effective. Who knew that a simple Excel sheet could have such longevity and impact?

The logic for bank rec is simple: Cash on Trial Balance = Balance on the bank statement – Outstanding payment + Deposit in Transit.

However, it can get messy when there are a lot of transactions and multiple people performing the AR and AP tasks. Here are some problems I encountered:

- Duplicate or missing deposit entries.

- Returned items – the items weren’t reversed in the system.

- Journal entry errors – switching debit and credit.

- Voided checks – but not actually voided in the system.

- Human errors – entering incorrect amounts.

- Checks printed wrong – we used pre-printed checks, meaning you print the check, you need to make sure the check number in the system matches the number on the physical check.

Once, a payment batch was printed, but the check order was reversed, and the checks went out like that. Here’s what happened:

In the system, we had records of the checks:

- #1001 for Verizon for $1200.00

- #1002 for ATT for $560.00

- #1003 for American Express for $15000.00

However, what actually printed was:

- #1001 for American Express for $15000.00

- #1002 for ATT for $560.00 – this one matched.

- #1003 for Verizon for $1200.00

- Etc…

I remember that there were about 17 checks in that batch, and the problem wasn’t discovered until the bank rec. It was a nightmare to fix that problem with journal entries and make clear notes for the audit. (During the audit, the auditors make selections on AP, and support such as canceled checks and bank statements must be provided.) It was a good lesson for everyone, including the CFO who was the signer of the checks.

In today’s world, electronic payments have become the norm for most companies, minimizing the headaches that come with paper checks. However, there are still businesses that rely on sending checks to vendors. For these companies, it’s crucial to regularly audit the list of checks recorded in the system against the actual checks printed. This practice helps ensure accuracy and prevents potential discrepancies.

Despite the potential problems that can arise during business transactions, identifying and resolving issues is entirely possible. This is why bank reconciliation is so vital. Not only does it ensure that financial records are accurate, but it also helps detect and correct any discrepancies promptly.

Maintaining a regular and thorough bank reconciliation process can save a company from significant financial headaches and ensure smooth operations. This seemingly simple task plays a crucial role in the overall financial health of a business.

By prioritizing bank reconciliation, companies can safeguard their financial integrity and maintain a clear, accurate view of their cash flow. In the end, the effort put into this process pays off, providing peace of mind and stability in an ever-changing business landscape.

So, whether your company is embracing modern electronic payments or sticking with traditional checks, never underestimate the importance of bank reconciliation. It’s a small but mighty tool that keeps your financial ship sailing smoothly.

Feel free to share your own experiences or tips for maintaining an effective bank reconciliation process. Let’s continue the conversation and learn from each other!

Stay tuned for more accounting adventures!