In the world of personal finance, there are countless strategies to build wealth, but one often overlooked gem is the employer-sponsored 401K plan. For me, the 401K played a significant role in growing my portfolio, and the journey, although long, proved to be incredibly rewarding. Here’s a closer look at how my consistent contributions and my employer’s match helped transform my financial landscape.

The Start of the Journey

My journey began with a simple decision: to take full advantage of my employer’s 401K match. Many companies offer to match a portion of employee contributions, essentially providing free money towards retirement savings. Ignoring this opportunity would have been like leaving money on the table. So, I committed to maximizing my contributions to ensure I received the full match.

Understanding the Company’s 401K Match Policy

Under the company’s policy, employees must have been employed for more than a year to be eligible. Once eligible, the company provides a 100% match on the first 3% of contributions and a 50% match on the next 2% contributions.

While the policy may sound straightforward, many employees had questions about how it worked in practice. Here are some examples to illustrate:

Example 1:

- Weekly Salary: $2,000

- Employee’s Contribution: 2% = $40

- Employer’s Match: 2% = $40

Example 2:

- Weekly Salary: $2,000

- Employee’s Contribution: 4% = $80

- Employer’s Match: 3.5% = $70

Example 3:

- Weekly Salary: $2,000

- Employee’s Contribution: 10% = $200

- Employer’s Match: 4% = $80

These examples clarify how the company’s matching policy can significantly boost your retirement savings. By understanding and leveraging this benefit, you can make the most of your contributions.

Consistent Contributions

Consistency was the foundation of my approach. Month after month, I diligently allocated a portion of my salary to my 401K. It wasn’t always easy—as you can imagine, there were moments when other financial obligations forced me to reduce or even skip contributions. However, I remained steadfast in my commitment to contribute at least 6% to maximize my employer’s match.

Growth Over Time

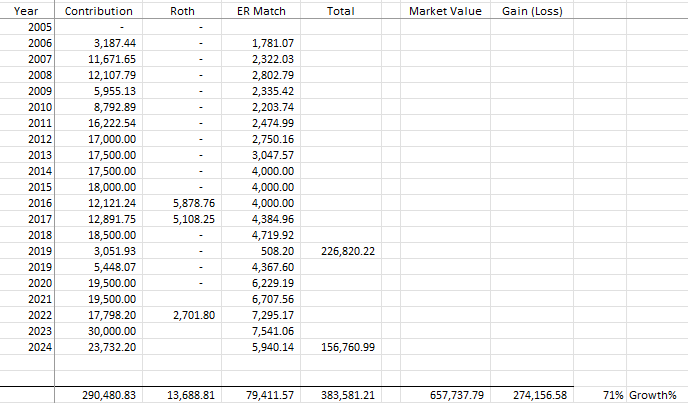

The true magic happened over time. Here’s a breakdown of how my contributions and my employer’s match grew:

Please note that these figures are simplified for illustrative purposes. Actual growth may vary based on market conditions and specific investment choices. As of January 2025, the market value was calculated based on my investment choices. While market values fluctuate over time, the general trend has been upward growth. A $274K gain on the total $383K contribution over a 20-year period might seem modest at first glance. However, the starting point was zero, and it took two decades to reach $383K. The growth journey will continue as the investment compounds over time.

The Result

After years of dedication and disciplined saving, my 401K has become a cornerstone of my million-dollar portfolio. It’s a testament to the power of taking full advantage of employer benefits and the importance of consistency in long-term financial planning.

Final Thoughts

Maximizing your employer’s 401K match might not seem like a revolutionary strategy, but it can have a profound impact on your financial future. By committing to consistent contributions and leveraging the employer’s match, you can build wealth over time. It worked for me, and it could work for you too.