In the realm of accounting and financial management, the Chart of Accounts (COA) plays a crucial role. It’s essentially the backbone of your financial system, providing a structured framework for organizing and categorizing all of a company’s financial transactions. Let’s dive into the essentials of a Chart of Accounts and why it’s indispensable for any business.

What is a Chart of Accounts?

A Chart of Accounts is a list of all accounts used by a business to record and organize financial transactions. Each account in the COA is assigned a unique identifier and falls into one of several categories, such as assets, liabilities, equity, revenue, and expenses. This structure allows businesses to accurately track and report financial data, ensuring transparency and compliance with accounting standards.

Key Components of a Chart of Accounts

- Assets: These accounts represent what the company owns. Common asset accounts include cash, accounts receivable, inventory, and fixed assets.

- Liabilities: These accounts track what the company owes. Examples include accounts payable, loans, and accrued expenses.

- Equity: This category represents the owners’ interest in the business, including common stock, retained earnings, and dividends.

- Revenue: These accounts record the income generated from the company’s primary operations. Common revenue accounts include sales, service income, and interest income.

- Expenses: These accounts track the costs incurred in generating revenue. Examples include salaries, rent, utilities, and depreciation.

Why is the Chart of Accounts Important?

The COA is essential for several reasons:

- Organization: A well-structured COA helps businesses systematically organize financial data, making it easier to find and analyze specific transactions.

- Consistency: It ensures that transactions are recorded consistently, reducing errors and improving the accuracy of financial reports.

- Compliance: By categorizing transactions correctly, businesses can adhere to accounting standards and regulations, avoiding potential legal issues.

- Decision-Making: A detailed COA provides valuable insights into a company’s financial health, enabling informed decision-making and strategic planning.

Tips for Creating an Effective Chart of Accounts

- Tailor to Your Business: Customize the COA to reflect the unique needs and operations of your business. Avoid using a generic template that may not suit your specific requirements.

- Keep it Simple: While it’s important to have detailed accounts, avoid unnecessary complexity. A streamlined COA is easier to manage and understand.

- Review Regularly: Periodically review and update the COA to ensure it remains relevant and accurate as your business evolves.

- Leverage Technology: Use accounting software to manage your COA efficiently. Many modern systems offer customizable templates and automated features to simplify the process.

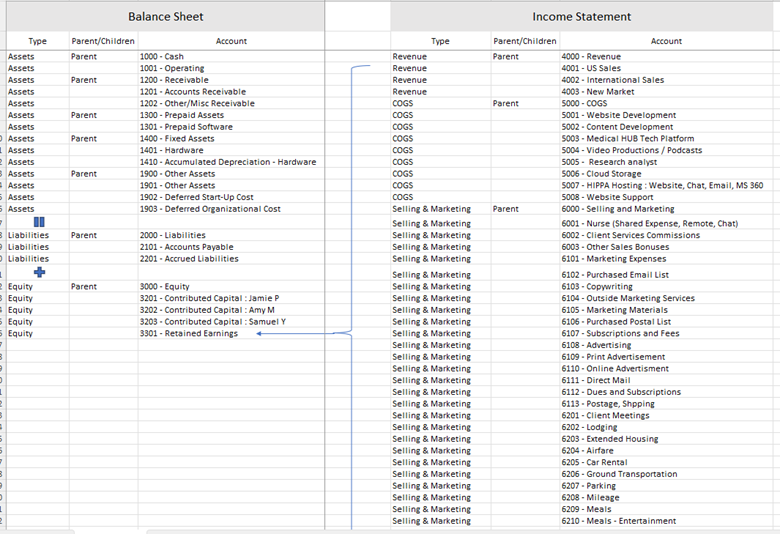

*Example: Below is the Chart of Accounts (COA) I created for my startup client:

Conclusion

The Chart of Accounts is more than just a list of accounts—it’s a vital tool for maintaining financial order and integrity. By understanding and effectively managing your COA, you can enhance your business’s financial transparency, compliance, and decision-making capabilities. Whether you’re a seasoned accountant or a business owner, investing time in creating and maintaining a robust Chart of Accounts will pay dividends in the long run.