Understanding Lease Accounting: A Deep Dive into Amortization Schedules and Journal Entries

Lease accounting is a vital aspect of corporate finance and business operations, especially with the introduction of standards like ASC 842, which transformed how leases are recognized and reported. Whether you’re dealing with operating leases or finance leases, understanding the intricate details of lease amortization schedules and journal entries is key. Today, we’ll explore these concepts based on a practical example.

What is a Lease Amortization Schedule?

A lease amortization schedule serves as a roadmap for tracking lease payments, interest expenses, the amortization of lease liability, and associated balances over time. Think of it as a financial ledger for a lease agreement, detailing every transaction throughout its lifecycle.

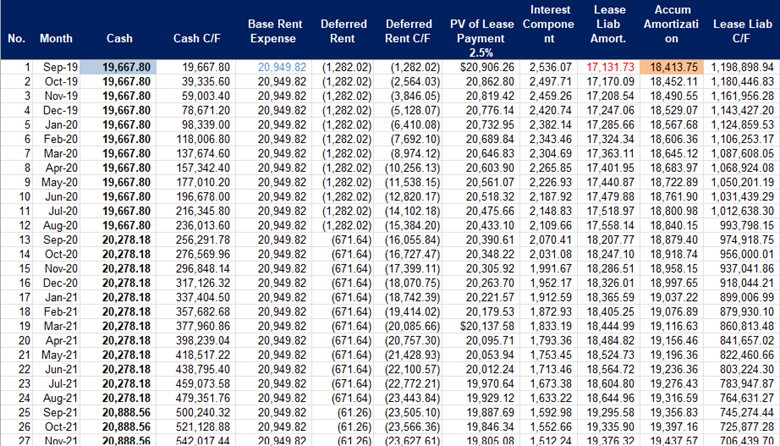

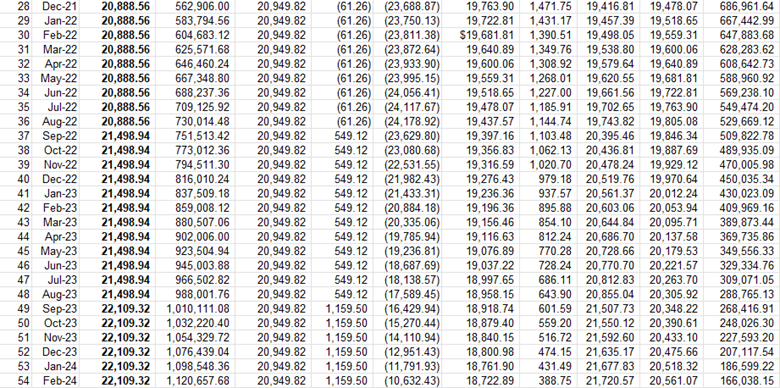

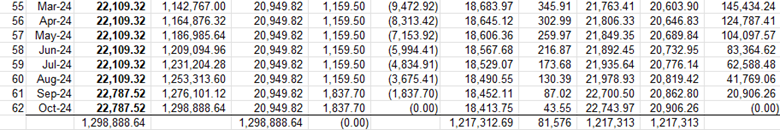

The sample schedule attached below includes:

- Monthly cash payments and their carried-forward balances.

- Base rent expense and deferred rent calculations.

- Present value (PV) of lease payments and their associated interest components.

- Lease liability amortization and accumulated amortization.

In essence, this tool helps businesses reconcile lease payments with their financial statements and ensures compliance with regulatory standards.

Breaking Down the Journal Entries

Journal entries are critical for accurately recording lease transactions. Here’s how they unfold step by step:

- At Lease Commencement: Record the initial recognition of the lease liability and the right-of-use (ROU) asset:

- Dr. Right-of-Use Asset: $1,217,312.69

- Cr. Lease Liability: $1,217,312.69

This establishes the balance sheet impact of the lease, aligning with its present value.

- Monthly Lease Transactions: Monthly entries capture the straight-line lease expense, interest component, and cash payments. For example:

- Dr. Amortization of Lease Liability: $17,131.73

- Dr. Straight-Line Lease Expense: $20,949.82

- Cr. Accumulated Amortization Change: $18,413.75

- Cr. Prepaid Rent: $19,667.00

The calculations ensure that expenses are spread evenly across the lease term, reflecting a straight-line approach.

- Subsequent Months: The process repeats with updates to the amortization and interest calculations:

- Dr. Amortization of Lease Liability: $17,170.09

- Dr. Straight-Line Lease Expense: $20,949.82

- Cr. Accumulated Amortization Change: $18,452.11

- Cr. Cash: $19,668.00

Each month adjusts the financial position and lease liability, ensuring ongoing accuracy.

Why Lease Accounting Matters

Understanding lease amortization schedules and journal entries is more than just a compliance exercise—it empowers businesses to manage financial impacts and make informed decisions. Accurate accounting helps:

- Streamline financial reporting.

- Ensure adherence to standards like ASC 842.

- Provide transparency to stakeholders.

By mastering these processes, companies can better navigate the complexities of lease agreements, ensuring their financial statements remain robust and reliable.

Lease accounting might seem intimidating at first, but with the right tools and understanding, it becomes manageable. Amortization schedules and journal entries are essential to demystifying leases, offering a structured way to capture and report financial data.

Want to dive deeper or explore specific nuances of lease accounting? Let’s keep the conversation going in the comments below!

Awesome https://lc.cx/xjXBQT

Good https://lc.cx/xjXBQT

Good https://lc.cx/xjXBQT

Very good https://lc.cx/xjXBQT

Very good https://t.ly/tndaA

Very good https://rb.gy/4gq2o4